1099 income tax calculator

What will income tax cost you. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

If your net church employee income or total church income subject to self-employed tax is under 100 you will not owe any self-employment taxes.

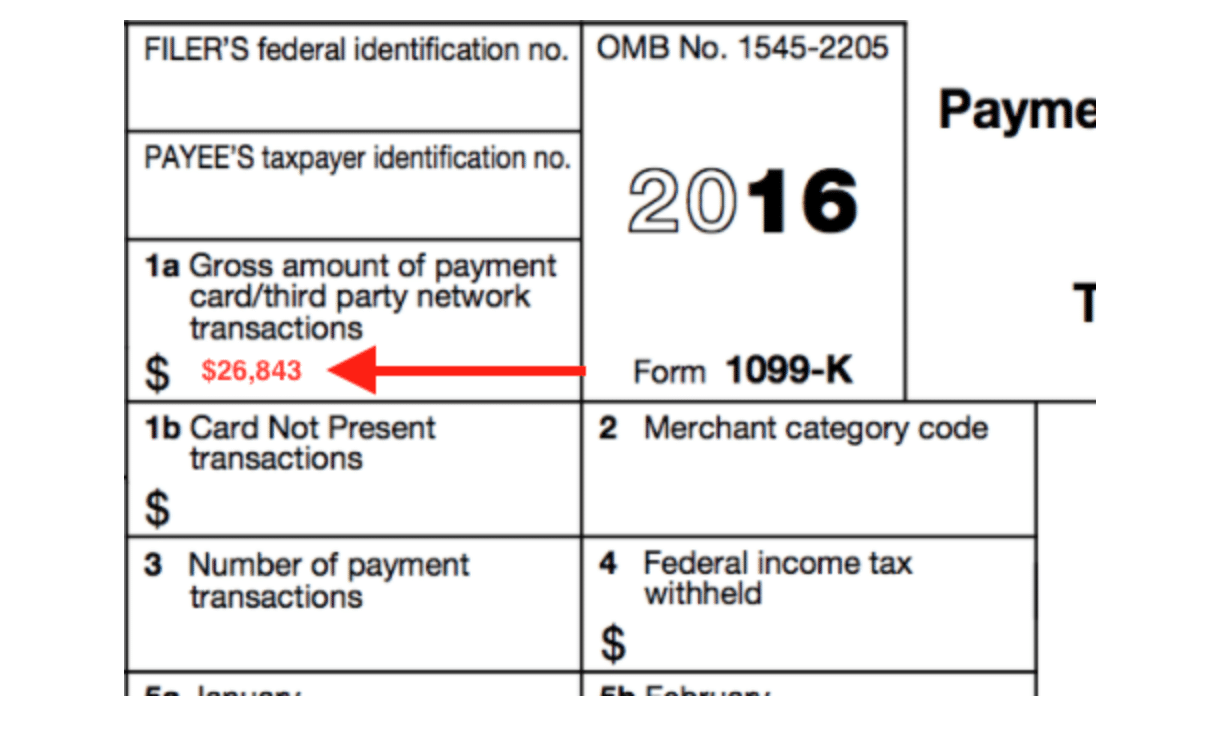

. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is filed While the annual return. Any income thats reported on a 1099-NEC or 1099K is considered self-employment income Self-employment income is just code for non-W-2 It can come from running a small business freelancing or just working a casual side hustle. Instead if you itemize your deductions you can claim your losses up to the amount of your winnings.

If youve wondered about e-filing here are the answers to frequently asked questions including why e-filing is a good idea which states let you e-file how much e-filing costs and how soon youll receive your refund. Form 1099-INT Interest Income Form 1099-DIV Dividends and Distributions Form 1099-SSA Social Security Benefits Statement Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs. Estimate your tax refund with our free online income tax.

Baca Juga

If you have any questions concerning this Tax Calculator please call 304 558-3333 or 1-800-982-8297. You dont owe taxes on side hustles. Individual income tax rates range from 0 to a top rate of 7 on taxable income.

- You made 400 in self-employed1099 income. Most self-employed individuals end up in the 10-22 income tax range with most people having an average or effective tax rate of around 14. Estimate your tax refund and where you stand.

Income from state and local income tax refunds andor unemployment. Almost every type of income is subject to income tax. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April.

However you dont necessarily have to report this amount on your federal tax return or pay additional federal taxes. February 1 Due Date to IRS. This calculator is for the tax year 2022 which is payable in April of 2023.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Financial institutions must issue this form for interest income payments exceeding 600 within one year. Fortunately you do not necessarily have to pay taxes on all your winnings.

Taxable alimony received Applicable to divorces finalized before January 1 2019. When you receive a refund offset or credit of state or local income tax that amount appears in box 2 of the 1099-G form. Self-employment tax consists of 124 going to Social Security and 29 going to Medicare.

It is not necessary to attach the 1099-G to your tax return. 2021 Tax Calculator to Estimate Your 2022 Tax Refund. Start with the 2021 Tax Calculator - TAXstimator- and estimate your 2022 Tax Refund or Tax Return results.

Form 1099-C reports the cancellation of a debt which is sometimes a taxable event and Form 1099-NEC reports payments to independent contractors. For example 1099-DIV informs the IRS that you were paid potentially taxable dividend income. Dozens of special situations call for a Form 1099 but they all cover payments you receive that may.

Gambling income plus your job income and any other income equals your total income. W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction. The self-employment tax rate is currently 153 of your income.

Worked as a rideshare driver food delivery person freelance writer or other gig worker or independent. Investment incomevarious forms 1099 -INT -DIV -B etc K-1s stock option information. Only certain taxpayers are eligible.

This includes things like. For example 3000 in self-employment tax reduces your taxable income by 1500. In the 22 tax bracket that would mean an income tax savings of 330.

Electronic filing e-filing online tax preparation and online payment of taxes are getting more popular every year. Due Date to Recipient. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications.

Tax brackets are adjusted annually for. 1099-MISC income from other sources used by self-employed individuals. If you receive a 1099-INT the tax form that reports most payments of interest income you may or may not have to pay income tax on the interest it reports.

Even if you dont receive a 1099 or if the income you earn from a client is less than 600 youre still required to report the income on your tax return. Your federal taxable income is the starting point in determining your state income tax liability. The Sales Tax Deduction Calculator IRSgovSalesTax figures the amount you can claim if you itemize deductions on Schedule A Form 1040.

And is based on the tax brackets of 2021 and 2022. Form 1099-SSA Social Security Benefits Statement. Form 1099-R Distributions From Pensions Annuities.

It is mainly intended for residents of the US. Income from jobs. Enter your filing status income deductions and credits and we will estimate your total taxes.

Form 1099-DIV Dividends and Distributions. 1099-R StateLocal Tax Rate. Forget that paper tax return.

Prepare and eFile your 2021 Taxes by April 18 2022. What about backup withholding. 4797 Sales of Business Property.

You can no longer eFile your 2019 Tax Return. Note under the tax reform law the gambling loss limitation was modified. Income Tax Return for Seniors.

Click the following link to access our 2021 income tax calculator. 2022 Simple Federal Tax Calculator. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

1099-S Proceeds From Real Estate Transactions. Normally the minimum threshold for payments before you need to issue a 1099 is 600. Most individuals and businesses in the United States are obligated to pay taxes and file tax forms to the Federal government.

For the full details check out the IRSs clarification. This 2019 Tax Calculator will help you to complete your 2019 Tax Return. For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125.

Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. For reporting nonemployee compensation such as income earned as an independent contractor freelancer or self-employed individual. 5405 Repayment of the First-Time Homebuyer Credit.

The good news is that you can deduct half of the amount you pay in self-employment tax from your income on your Form 1040. Calculator Guide A Guide To The 1040 Tax Form Frequent Tax Questions. Form 1099-INT Interest Income.

Forms W-2 for you and your spouse. What does it mean to have 1099 income. Situations covered assuming no added tax complexity.

Real Estate Tax. If you backup withhold you must issue a Form 1099 no matter what the payment amount was. Reporting 1099 Income and Non-1099 Income.

Continue to the Tax Calculator.

How Much Taxes Do I Pay On 1099 Income Tax Calculator

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

New Form 1099 Reporting Requirements For 2020 Atkg Llp

Income Tax Calculator Estimate Your Refund In Seconds For Free

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Flyfin Offers Free 1099 Tax Calculator To Help With Self Employment Tax

A Guide To Independent Contractor Taxes Clockify

Fha Loan With 1099 Income Fha Lenders

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Free Self Employment Tax Calculator Shared Economy Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

1099 Taxes Calculator Widget

Form 1099 Misc Miscellaneous Income Definition

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

1099 Int Interest Income

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub